Bill Hansen, CEO of Building Hope, and Raphael Gang, Director of K12 Education at Stand Together Trust, joined me to discuss the launch of a pioneering microloan fund specifically designed for microschool founders. We explored the goals, mechanics, and early learnings from the pilot program, which offers low-interest startup loans to help microschool entrepreneurs navigate financial and facility challenges in the early stages. Our conversation highlighted the critical need for business fundamentals and sustainability within these innovative educational ventures, the vital role of technical assistance, and the importance of building scalable, sector-wide support for nontraditional school models.

Michael Horn

Welcome to the future of Education. I'm Michael Horn. You're joining the show where we're dedicated to creating a world in which all individuals can build their passions, fulfill their potential, and live lives of purpose. And today we're going to have a conversation with two leaders behind a relatively new micro loan program that is designed to support what I'll call the supply side of microschools. But we'll unpack that, I suspect, a little bit as we get in this conversation. Before we do that, let me actually introduce our two guests. We have none other than Bill Hanson. He's the president and CEO of Building Hope.

Bill, good to see you.

Bill Hansen

Good to see you, Michael. Thank you.

Michael Horn

Yeah, absolutely. And then we have Raphael Gang. Raphael is the director of K12 education at Stand Together Trust. Rafael, good to see you.

Raphael Gang

Thanks for having me.

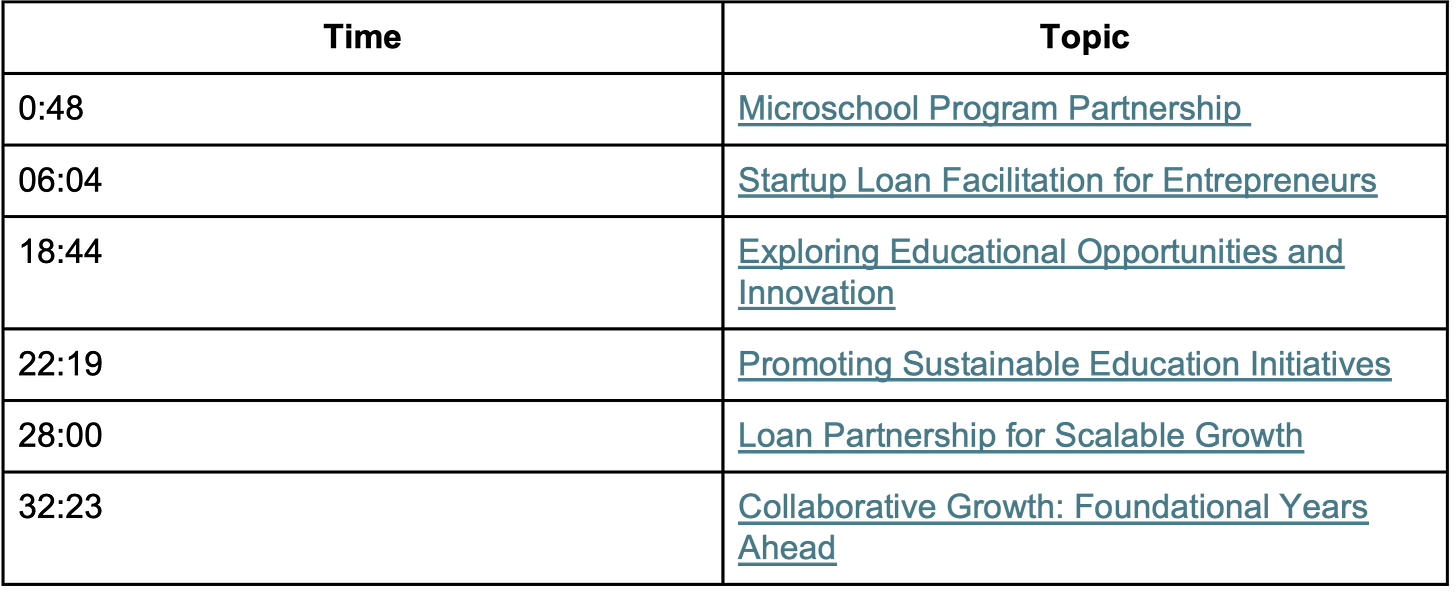

Microschool Program Partnership

Michael Horn

It's great. Yeah, no, you bet. So let's dive in with the mechanics, basics, just so people know what we're talking about. As I understand it, this is the first of its kind fund for microschool founders. It launched with $675,000, I believe, in funding from Stand Together Trust with support from the Beth and Ravenel Curry Foundation, I think. Is that right? And then it's powered by Building Hope and it's essentially a low-interest loan program. And so I'd love to get the basics of this, like what are the loans for, how much are we talking, what's the structure of those loans, how many applicants did you get, how many did you give out, and so forth.

So maybe, Bill, why don't you lead us off and then Raphael, if anything to add, you can jump in on this.

Bill Hansen

Thank you, Michael, and just really appreciate the partnership with Raphael and with the Stand Together Trust. It's really been a pretty intense several months here getting this really, we're calling it a pilot or a demonstration program established to really help us learn a lot about this marketplace and the needs. And, you know, just with Building Hope's history in the public charter school movement, mostly, you know, the biggest barrier has always been both the financing and the facilities, and that is on steroids here with the microschool program. And so really the, you know, I really feel like we're in a learning process here to really, you know, help us validate those challenges that these entrepreneurs around the country are making and to really help solve the greatest needs that they have. And really the barriers to entry, which really have been, the logistics, the housing, if you will, and also just really the startup cost for them.

Raphael Gang

Yeah.

Michael Horn

And so let's talk about the loan itself. Raphael, why don't you jump in there? Yeah, yeah.

Raphael Gang

I mean, we were really excited. I mean, we spent two years looking for the right partner for this. So I would double down on Bill's, the appreciation for what Building Hope has done over the past six months or so, eight months, to build out the loan fund. And it's been a real process and you need a lot of trust and a lot of partnership to do something that's as ambitious and fast moving as this project has been. So, I mean, the loan fund, you know, we put out a very soft request to folks. We didn't do some big major advertising blitz. We went out through a network of partners that we talked to and we said, you know, who is looking for affordable capital, essentially? And we really were looking.

I think Bill makes a really good point there if we were looking to learn about the market as much as we were learning to help founders of microschools. We know that these microschools are out there. We are seeing through organizations like the national microschooling center and vela.org just tremendous growth in them. But we don't really have a grip on, well, what are their finances look like? What does their growth strategy look like? What are their needs? And so I was having a lot of conversations with folks where I'd say, hey, what do you need? And a lot of folks would come to us and say, I need capital. I need money. I need money to get started. Or I'm in my early days of my first few years of operating. I need capital.

Cash flow or ESA programs or voucher programs are coming online, but I need a little cash flow because they're on a delayed payment, things like that. So we really tried to structure the loan fund in a way where it acknowledged the reality of these folks that are on the ground and what their needs are. So we're not asking for immediate repayment of things. We went out and talked to those folks and we said, what's a loan? What's a timeline that makes sense and when should the payments happen? And Bill can talk more about the details of that, but we came in at 3% interest rate, which is a very generous interest rate, as anyone in the finance industry can tell you. But a lot of it was about like, well, we want to see who's out there and we want to learn about them. And so Bill and his team have done an amazing job of collecting that data and now using it to inform what we're doing. We're really excited.

I think we're on track to make about eight or nine loans by the end of the process. We'll probably still have a little bit of money left by the end of it, but I think we're in a really great place, to really get the money out the door. But, but as well, like really inform kind of where we go from here. Does that answer your question?

Michael Horn

Yeah, that does. So that. And you sort of teed up the next question, which is I think you got 53 applicants. So you're talking eight or nine folks will get loans.

Raphael Gang

Yep.

Michael Horn

What are they going to use the capital for? What are those repayment terms? How big are the loans? Like what, what order of magnitude are we talking about here? Bill, you want to take it?

Startup Loan Facilitation for Entrepreneurs

Bill Hansen

Sure. Well, the loans are, you know, probably going to be in the 25 to $50,000 range. And again, these are really startup costs that these individuals and entrepreneurs are needing to get through all of the regulatory processes, all of the onboarding of, of students and whatnot. So. And really the facilities is probably still the, I would say, the predominant need for it. And you know, I just really would also maybe just echo what Raphael was saying about the intersection of philanthropy and you know, we're a non profit organization, but we have, you know, three businesses that are, you know, we're the biggest financial advisor in the charter school business. We've got a nonprofit subordinated lending program, do a lot of work with the credit enhancement program for the Department of Education, the Small Business Administration, and really just trying to help navigate, you know, through these processes that they've probably never done before and you know, maybe just with their local banker and so, you know, trying to bring, you know, get the lowest cost loans available to them is really, I think one of the benefits of the partnership with philanthropy and a nonprofit organization involved in the lending business.

Raphael Gang

Yeah, I think we've got, you know, I think we had 258 application or interest forms. Interest forms. We had 100 folks start at the applications. We had 53 full applications that came through the process. And it looks like we'll get to about 8 to 10 loans distributed and they're going to be in that range that Bill talked about. We deliberately really said, let's keep the loan dollar amount low. These are microschools, they should be micro loans, so to speak. And we really felt like we didn't want to be a, we wanted to see how far we could stretch those dollars and really can that money be catalytic, especially at the earliest stages for folks.

But we saw that a lot of the challenges that are coming through with that were, were really about the business practices that founders were going through. There were challenges with facilities. Facilities are no doubt a real challenge that a lot of microschool founders deal with, especially at the front end of their process. But I think a lot of what we're seeing in the process has been the business fundamentals. And how do you help schools make sure that they have the right pricing strategy, make sure that their tuition is actually going to lead them to net income and that they are, they have good accounting practices. And what I think Bill and my team probably have said, we've said this to each other so many times, it's kind of hilarious at this point. But how much this reminds us of the early days of charter schools where there's so much energy and there's so many ideas and there's so many great people that are flowing into the the area. But the challenge of really having good business fundamentals, business practices, making sure that people are doing things the right way so that they are positioned to grow and positioned to scale and aren't taking on lots of credit card debt or taking out their 401ks and things like that, it's been a real learning curve around that.

Michael Horn

Well, so that actually is a question that I'm glad you, you just sort of alluded to that, Raphael, because something that I've observed is a lot of these school founders, microschool founders in some cases seem uninterested or uncomfortable with the idea of a business model and they're not necessarily thinking about sustainability. So I guess my curiosity plays into that, like how did you whittle from 53 applications to the eight or nine that will get it? What's the criteria you're using there? And I guess the second part of the question is why do loans instead of say, grants to these folks that you ultimately choose?

Raphael Gang

Yeah, Bill, I mean, you can talk about the rigor of your process. I think that's actually been one of the things that I think is the best thing about this product.

Bill Hansen

Yeah, number one, we're just very, very fortunate to have a terrific leader inside our organization, Allison Serafin, who is just, I can't even tell you the countless hours she spent. You know, I've actually lost Allison, who is our, she is our executive for all of our business development work. But she also happens to be probably one of the most detail oriented individuals I've ever worked with. And that's just been incredibly important as she's been pouring through these applications. But she also has the boots on the ground expertise of, you know, being in a school, serving on the state Board of Education in Nevada and others. And just really I think has the vision as well of understanding what the capacity building tools and the technical assistance needs are going to be of these schools and really what success can look like with these potential applicants. So even though we have our matrix and our different indicators of success, a lot of this is also just Allison's eyeball to eyeball contact with each of these organizations. And again, I just, I don't want to lose that and you know, what our diligence process has been about, but really just, you know, having that boots on the ground ability to understand, you know, what success, you know, can look like.

And really. And also I would just even say that it hasn't just been your typical banking approval process. I think the technical assistance that, you know, we've even been able to provide in schools, even those that, you know, maybe ended up on the cutting room floor, are still better coming through the process because of the learning along the way as well from what they need as entrepreneurs and small business leaders.

Raphael Gang

Yeah, I think Allison has done an incredible job of kind of, I would say, getting in the mud with the process while still holding, I think, a rigorous bar for what we think are credit worthy applicants. And I think it's that kind of clear as kind of approach where Allison has really adopted this approach. And Bill is, if anything, understating the number of hours when he says countless hours. But like, Allison spent so much time talking one on one with the founders, asking them about their models, getting into the weeds, learning about where, why is this on your balance sheet? Why is this in your budget? How are you structuring this? Why are you doing this? And so it benefits the loan fund overall because I think we now have a much more robust understanding of what the challenges are and what the needs are for these founders. And so we're better positioned as we move forward to provide even better technical assistance and things like that, that. But Allison has told me this repeatedly that there's many founders who ended up not getting loans through our process who at the end of that have said, thank you. Why hasn't anyone told me this till now? And I think that actually gets to your second question, Michael, which is we've really, I, you know, I speak as a member of philanthropy, so it's kind of like. But I think there's a way in which philanthropy can do itself no favors in situations like this, where grants are really great in certain forms of capital to help people start things, to grow things.

It's a great form of risk capital because obviously philanthropy doesn't expect the money back for the most part. But I think philanthropy can get into trouble when it is not thinking about how to create sustainability for the organizations it works with and how to encourage that really at every stage. And I would say, like, I've made this mistake in several partnerships that I've worked on and things like that, where I think we have a tendency to think the money is always going to keep being there. We don't need to have all the details worked out. We don't need to have the solid fundamentals of how is this school, how is this thing going to stand on its own feet at some point? And I think in all of the excitement around microschools and the excitement of, like, oh, look at this really cool environment. Look at this really great founder. Look at this really great community that they've built, I think we have, in certain situations, overlooked, like, well, do they have a viable budget?

Is the founder paying themselves a reasonable salary? You know, I don't think anybody gets into this to make millions of dollars.

Michael Horn

Sure, but it should be a sustainable thing you could do for several years.

Raphael Gang

Yeah, exactly. And so what we saw was, you know, a lot of founders doing great things. They had great families involved. Everybody's excited. And then you look at the business fundamentals of the budget, the cash flow, the reserves, the debt, all of those things. And it was really kind of heartbreaking, candidly, because we really felt like if someone had gotten to these folks earlier and someone had really talked to them and engaged with them and been really clear with them about, like, no, this is what it needs to look like. This is how the numbers need to add up.

This is how to do this. And so Allison has spent a lot of time and a lot of energy and a lot of emotional energy, I think, trying to be both this kind of firm, but firm support, I guess, to help founders through this process of understanding really what does sustainability look like for you? And is this actually going to help you. Is a loan which is, you know, just debt, basically, is that actually going to help you to get to a better place as an organization, or is that actually digging the hole deeper?

Michael Horn

Yeah, it's really interesting. And is this the right capital for you? I'm glad you guys are pushing on this and helping because this has been a big concern I've had with the space and sort of thinking of spaces. Bill, I want to bring you back in here because it's interesting to me that Building Hope has really been synonymous, I think it's fair to say, in the charter school space for a variety of school financing options, helping create custom facilities for charters, providing discounted services on and on. Right. And really just making it much easier to launch and then operate charters. So why move into the microschool space now and do this pilot like why that I won't say shift, but add on. Right. Of another sort of service that you all are providing in another sector.

Bill Hansen

Thanks Michael. I, you know, just came here a little over two years ago just really with agreement with our board that we really wanted to build on what made Building Hope special the previous 20 years. You know, we really helped Washington D.C. almost exclusively for the first 10 years of our existence. And you know, the low cost financing, the, you know, capacity building, the technical assistance, the construction side of things. And you know, and I really wanted to help us expand out, I think just the national. And again, I'll go back to, you know, former deputy Secretary of Education. I just really, you know, and I'm vice president of the State Board of Education of Virginia and just seeing the national landscape changing and also being a grandparent of 17 grandkids and going through Covid just looking for, you know, more choices, more opportunities, more just innovation in the sector.

Exploring Educational Opportunities and Innovation

Bill Hansen

And so I really worked with our board to look for some adjacent opportunities for us, whether it's in higher education with historically black colleges or the for-profit charter space or even other private schools. But you know, to me the microschool program, it's a little personal to, you know, I've got, you know, one of my daughters with five kids during, you know, Covid pulled her kids out of school, public school system and started homeschooling them. And you know, she was kind of led through a journey of, you know, cooperative schools and working with some religiously affiliated schools a couple days a week. But you know, really it was wonderful to see her entrepreneurial spirit kind of kick in, but also just the like minded, mostly mothers who you know, were trying to do the same thing. And you know, so I just am really grateful that you know, Building Hope, I feel like, you know, really the first 10 years, the second 10 years, also working with really important philanthropic leaders like the Albertson Foundation where I think we've revolutionized what's happened in Idaho and also in the state of Florida where we administer the School of Hope program there. Really just looking to, you know, take our capabilities and you know, large districts like D.C. large states, philanthropy, and just make a deeper impact across the board.

And so just I actually remember our first meeting, at a restaurant at National Airport. You know, and it just, you know, looking to, you know, these like minded folks that are really trying to change the landscape and to really, you know, help build opportunity for just, you know, and to really build upon the, the national landscape, that's just, I just think it's not going to turn around. I think, you know, we just have got to figure out how can we accelerate and amplify and, you know, the demand if it's out there and really bring, you know, different choices to, you know, families that have very different needs and very different approaches to, you know, how they want to educate their children.

Michael Horn

Well said, well said. So we've said multiple times, this is a pilot you're aiming to learn. You sort of dropped in some of those lessons along the way. But I want to more clearly ask the question, so I don't neglect that, of what are you learning? What are the big takeaways, lessons, anything that surprised you, uses of capital to something else. You know, you tell me what's jumped out. Raphael, why don't you kick us off?

Raphael Gang

Yeah, no, I mean, I think the big learnings have been that this business fundamentals question is really the core. And I think the same way it was the core question for the growth of charter schools. It's kind of the unsung story within the charter school sector is the work that folks like Building Hope did over the last 25 years. People don't talk about it, but it's like, yeah, that's how you build the new building. That's how you serve a thousand more kids here and 500 more kids here and all that kind of stuff. And it started, you know, people see the building and think that the building was the thing. It started with the business fundamentals being great. It started with families being there, but them having a really strong operating model and being clear about how they were going to make it work and how they were going to grow sustainably.

Promoting Sustainable Education Initiatives

Raphael Gang

And so I think that's the number one takeaway for me is we need to really think hard about how we encourage that sustainability on the front end. It's really hard once people are operating and if they're in debt or if they're in a bad lease or if they're in a bad situation around their finances, it's really hard to dig out of that, especially at the scale that folks are operating at. So I think we're really thinking long and hard about what does technical assistance look like in the future and also how do we encourage on a kind of more sector wide basis. And I think this is where thought leadership and some of the work that we're excited to do with Building Hope and the team comes in is how do we communicate what we're seeing? Like, this is what a good budget looks like, this is what a good net income looks like. This is what pricing and tuition models need to be. And there's people that have been doing this kind of work in charter schools and in private schools, right? You've got folks like, you know, Charter School Growth Fund and things like that. And you've also got folks like the Drexel Fund in the private school space that have done great work in both of these worlds around, like, how do you help people start strong? And I think what's really great about this is we now have data, we now have really strong data that tells us what does it look like to start strong and where we go from there. I think the other thing that I would say has been a big insight is that there's clearly demand.

Like people want this and people are excited about this. 250 interest forms, we had a hundred people on the webinar. We've gotten continued interest pretty much every week. We're getting people signing up and being like, when's it going to reopen? When's this going to happen? When's that? So I think we've found, you know, that was a question that I got internally is like, is anybody going to show up to this? Like, is this, you know, like, who's going to come to the party? And I was like, well, I'm not sure, but we're going to find out. And I feel like we had, we had a good party. We had a lot of people come to the party. And I think that feels really validating. And so the question is what? You know, how do we make that a great party where everybody leaves feeling great and feeling like they got what they, you know, they got some good food, they got some snacks, they're feeling bellies full, but they're not waking up the next day hungover, right? They're feeling good about where this thing is going to head.

Raphael Gang

And so I think that that feels really validating and good to kind of build the base of it. And I think the last thing I would say is that, you know, this project doesn't happen without the partners that we have. We had a bunch of partners that came together, the Curry Foundation, Building Hope, our team. But there's a lot of folks that were in this that were doing this work. You know, the Wildflower Schools foundation, they have been operating their own loan fund. We learned a tremendous amount from them about how they operate that fund and what is, you know, what does it look like? So we've been fortunate to kind of build on the backs of the work that Building Hope has done to date with charters and things like that. And so it's about learning lessons, but how do we really take those lessons and apply them appropriately to this very niche kind of group of people who, I think, for a long period of time, have essentially operated outside the needs of, like, actually getting capital.

Like, this is a very scrappy group of people. I mean, Bill's daughter included, right. Of like, you know, it's like, these are not people that call themselves entrepreneurs. They're not people that are like, I'm going to go out and build the next, you know, name your favorite school. Right. These are folks that were like, my kids were suffering during COVID and this is not working.

I need to build something better for them. And they didn't really realize it until after the fact. It's like, oh, there's like, 25 kids showing up at my house every day. Or, you know, we're doing something. Yeah. But to take that and that energy and turn it into a fundamentally sound business, I think that's the kind of head space that we're. You know, I think we're actually talking about really, like, change management. We're talking about changing people's identities of how they look at themselves.

Raphael Gang

Because a lot of the folks we're talking to, they're like, why would I need a loan? I'm not a. You know, I'm not a business. I'm not a. I'm not. I'm not one of those fancy people on Wall Street. I'm a mom who built something for my kids, and it just grew a little bit. And you're like, well, you got revenue in the hundreds of thousands of dollars.

You're looking like a business to me. So I think that's a big part of it is how do we help guide people through that process of something that's very different and make sure that they're ready for it. Right. We're not trying to set people up for failure. We're really trying to help people. But that's a big change for people to go through mentally and business wise.

Michael Horn

No, that makes sense. So let me ask a few lightning round questions as we start to wrap up here. And the first one would be, you both have mentioned other partners at the table, right? You mentioned Vela. You mentioned the National Microschooling Center. There's Wildflower. You mentioned. There's KaiPod. Right.

That will support entrepreneurs launching microschools. They're all doing different pieces of the puzzle. How does this vehicle fit in with all those different partners?

Raphael Gang

Yeah, I can go. I think we see it as an accelerant for everything that everyone else is doing. We see it as fuel on the fire. Right. Where we're adding a new perspective that hasn't really been at the table to date. Right. Wildflower has been doing it for their own folks. But we want to create something that really influences the sector and says, hey, this is what strong, sustainable microschools, or micro ventures, whatever they call themselves are.

Loan Partnership for Scalable Growth

Raphael Gang

And we chose this to be a loan, not a grant, because we know Vela is doing incredible work around that. And we wanted to do something that was really scalable and that we could grow. And that's why we were looking for a partner like Bill and the Building Hope team, because we knew that it was, you know, I might have my own kids and love, want to send them to a microschool, but I am not a finance expert. And we need, we need the expertise that these folks that the Building Hope team brings if we're going to really make a dent across the sector and make, you know, entrepreneurship available to so many more people.

Michael Horn

And I'm curious, Bill, from your perspective, like, another lightning round question of, like, who else should be at the table, you know, philanthropically? Like, what. What else do we need? What are the missing lanes that you're observing? You've seen lots of sectors, both in K12 and higher ed crest, and either make it or not. What. What other things should we be looking at?

Bill Hansen

It's both, you know, breadth and depth. I think as we learn, you know, it's gonna. We're gonna need to go deeper. You know, we're just, you know, one spoke in the, you know, the wheel of, even in the, you know, financial, operational and services side of the house, and I think philanthropy as well. And, you know, one thing we've learned too, I just think, and again, I really appreciate what Raphael said about, you know, just even the outreach to get this thing launched. You know, we did not run a national campaign.

We wanted to keep this manageable. We didn't want to tip over. We wanted to make sure, you know, that we were able to, you know, get a learning process in place. But, you know, but just a couple of things. You know, I don't think we had a viable applicant out of Texas or Florida, for example, but, you know, Virginia, which, you know, again, my home state is not a very positive charter school state. It's usually in, you know, the DRF category. And, but, you know, it's actually been at the lead here in terms of what we've approved. And I think that that's also going to be, you know, as we kind of dig into this, you know, I think we're going to see some things maybe geographically that, you know, will really lead us to different types of partners and, you know, where we are geographically and you know, possibly as well with, you know, I think there's, you know, just a strong infrastructure of, you know, women owned businesses, you know, leaders that I think that is a key to this sector.

And so I think, you know, there's going to be a lot that we're going to learn that might draw in, you know, those folks that, you know, maybe it's also maybe the SBA or, you know, some federal or state or other type of partners that could come into this. And, you know, just one other area too. I still feel like the regulatory beast out there of what these entrepreneurs have to overcome is an area as well where I think just getting some of that and, you know, Building Hope does that to some extent. But there's a lot of other regulatory and other challenges that are out there that I think could, you know, really attract some other partners to really help bring these and, you know, playbooks and whatnot to, you know, the entrepreneurs out there.

Michael Horn

Amen to that. Amen to that. Okay, last question, which probably just a one word answer, but you may both have a little bit more, which is you've done the pilot. Will there be another fund? Are we going to pony up for more?

Raphael Gang

Fingers crossed, yes.

Michael Horn

Fingers crossed, yes.

Raphael Gang

Yes. That is the goal. That is our goal that we want, we want to see that we want to make this even more available to more folks. And if anything, we want to go further on things like technical assistance, make it easier and faster for people to get feedback and be ready for capital.

Michael Horn

Terrific stuff. Terrific stuff, Bill.

Collaborative Growth: Foundational Years Ahead

Bill Hansen

Yeah, just the same, I just, you know, and again, I think getting the proof of, just to where, bringing other businesses and entrepreneurs, nonprofits, you know, to the table is going to be critical. So, I just, and again, I think the, hopefully the horse is out of the barn on this and, and just, again, if, how we can corral that and marshal the resources and the partnerships to really help us get where we all want to be in the next three to five years. And I do think the next three to five years are going to be really important in setting the foundation for this movement. And so just I agree. I should have just stopped the fingers crossed as well, but.

Michael Horn

No, but it's a critical time. I appreciate the role you both are playing, not just obviously with this fund, but throughout the whole ecosystem as we think about getting the structures in place so that this is not just sort of a small part of the offering, but it's a bigger part of the menu of choices that families have to make the progress that they need for their kids.